|

The ISP Column

A column on various things Internet

|

|

|

|

|

A Second Look at Geolocation and Starlink

November 2025

Geoff Huston

In September 2025 I wrote an article on Starlink and geolocation. This work was prompted by a question relating to the makeup of ISPs in the country of Yemen, where the data analysis point to a result where Starlink had some 6 million users in that country, or some 60% of the estimated user population of that country.

This result was easily classified as "dubious." There were just too many Starlink users in a county of some 40M people with just 10M users and a relatively modest GDP per capita of USD $500. Analysis of ISP market share in other countries gave results that matched conventional assumptions (and matched reasonably well available data, in the few instances where good data on this topic of ISP market share is publicly available), which meant that I started looking for other factors that may have impacted the Yemen result.

The factors I speculated about in that article included:

- Starlink use by shipping, where crews use Starlink on a global roaming services and aircraft in flight using Starlink for inflight Internet server of passengers. Starlink publish a map assign every IP address they use into a country, and that includes any IP addresses that are used by ships and aircraft where the ship or aircraft is located in international realms during its voyage. However, the anomaly was large enough that this factor could not account for an extra 4 – 5 million Starlink users that popped up in Yemen.

- Potential cross border global roaming, noting that in Yemen's case neighbouring Saudi Arabia has not reached any agreement with Starlink for the provision of services in Saudi Arabia. Starlink does permit roaming, through its roaming service plan, but if you roam to a location where Starlink is not authorised for use, Starlink may not provide any service, or may terminate the service after a period of two months. The text of the service agreement is less than definitive here, and while it's pretty obvious that Starlink can determine the precise location of a Dishy unit, the exact process Starlink uses to enforce the out of authorised use zone rules to Dishy use in such unauthorised locations is unclear.

- Community redistribution and "hotspots" based on Starlink. Here a single service may be used by hundreds or individual users, and while Starlink would count this as a single service, the ad-based measurement system, which counts instances of browsers on separate devices, would "see" the entire collection of end users in the same way as the measurement system counts individual users behind various forms of NATs.

These factors are plausible considerations in attempting to explain some parts of the anomalies in the observed ad placement data, but none really seemed to match the magnitude of the observed anomalies in some countries. In Yemen in particular, Starlink users were just getting a disproportionately high number of the ads placed on to end systems located in Yemen, and a base of 7 million Starlink users out of a total estimated 10 million large national Internet user base in Yemen simply sounded implausible.

So, it's time to look again at Yemen and see if there are additional factors that might explain what we are observing.

A Second Look at Data for Yemen

Civil unrest can often cloud measurement data. Some measurement systems, including this one, make relatively sweeping assumptions about the stability of both end user behaviour and network service behaviours, and assume that the changes that occur from day-to-day are minor. The data behind the market share of ISPs in the country of Yemen assumed at all retail Internet Service Providers (ISPs) in that country had a similar profile of presentation of online ads to end users, and this allowed us to make the inference that the count of ads per ISP was approximately aligned to the market share of each ISP.

There are weaknesses in this approach. Firstly, there is a mismatch in terminology. A mobile network's count of users is closer to the count of service subscriptions, or the count of active SIMs installed in mobile devices. It's probably a reasonable assumption that each device has a single end user, so in this case the count of subscribers is reasonably well aligned to the count of end users. A residential or enterprise ISP service is different, and here there is the general expectation that there is more than just one end user behind each ISP service. In this fixed-line environment, the terms subscriber count and user count encompass different concepts, and they will necessarily differ for such ISPs. What about Starlink? One would expect that Starlink is a lot like a retail ISP, where the numbers of end users exceed the number of services, but by a factor that would be similar that that encountered in other forms of fixed line access, as it is positioned predominately as last-mile retail access service as an alternative to a fixed line access service. (Yes, there is the use of Starlink community gateways in a number of locations, but the distinction between these configurations and direct-to-user Starlink services are obvious when looking at the Internet's routing trables as these Community Gateway networks use their own Autonomous System numbers when announcing their routes into BGP.)

Secondly, user behaviour necessarily changes in times of civil unrest and conflict. This sounds like a truism, but it has impacts in this form of measurement. Mobile services are often more resilient than fixed line services at such times, and users may turn to various forms of connection sharing. This includes "hot spot" redistribution of a mobile services to WiFi, so the assumption of a single mobile service roughly equating to a single user may break down in such times. The same consideration applies to Starlink. The Starlink service agreement includes the provision: "If you purchase a Priority Plan, you may resell access to the Services as community Wi-Fi or a “hotspot” to third-parties," (Starlink Service Agreement). So, it is likely that when 'normal' ISP services are disrupted due to civil disruption, people may turn to a shared service that provides them with vital information and services that are critical in such uncertain times, and the Starlink service subscriber may pool the contributions of each member of the served community to cover the cost of the service. The implication is that the number of users of Starlink services in a country may rise in such circumstances, even though the number of services may not rise to the same extent, and the per capita GDP seems to indicate that the service is unaffordable.

Obviously, Yemen is in such a state of civil unrest and there are a couple of relevant announcements that relate to the use of Internet services in that country that I've discovered since I wrote the original article.

The first is the announcement made on the 27th of April by the "internationally unrecognized" Houthi-run Ministry of Telecommunications where it ordered all citizens and entities in territories under the group’s control to surrender their Starlink satellite internet devices by May 1, 2025" (Press Report). As this article observes: "Starlink's satellite-based high-speed internet offers rare connectivity in Yemen, where war and infrastructure damage have crippled traditional services. The Houthi ban reflects their efforts to control information flows amid the ongoing conflict."

The second is an announcement by the Yemeni Houthi militia on the 30th of June 2025 where it gives notice that it had banned all Google Ad services on Yemen Net, which is the major Yemeni fixed line and mobile ISP. This ISP is reportedly controlled by the Houthi militia. (Report).

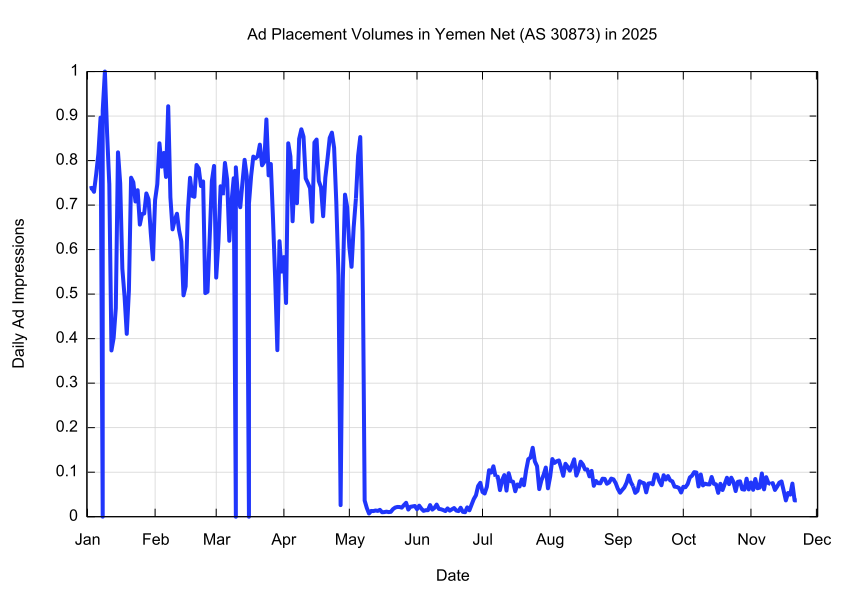

This second announcement is critical for our form of ad-based measurement, because ad-blocking limits our visibility into the network. We can observe the effects of this announcement in the ad placement volumes, as seen by subscribers of Yemen Net (AS 30873). The collected ad impression data shows that ad volume for this ISP dropped by 90% in early May (Figure 1).

Figure 1 – Daily Ad placement volumes for Yemen Net (AS 30873) in 2025

This is a case where presumably the number of users of Yemen Net has not changed substantially (we cannot definitely tell that from where we sit, as the only tool we have is Ad placement data), but the ad volumes for this ISP have plummeted.

Can we "restore" the calculation of market share for Yemen?

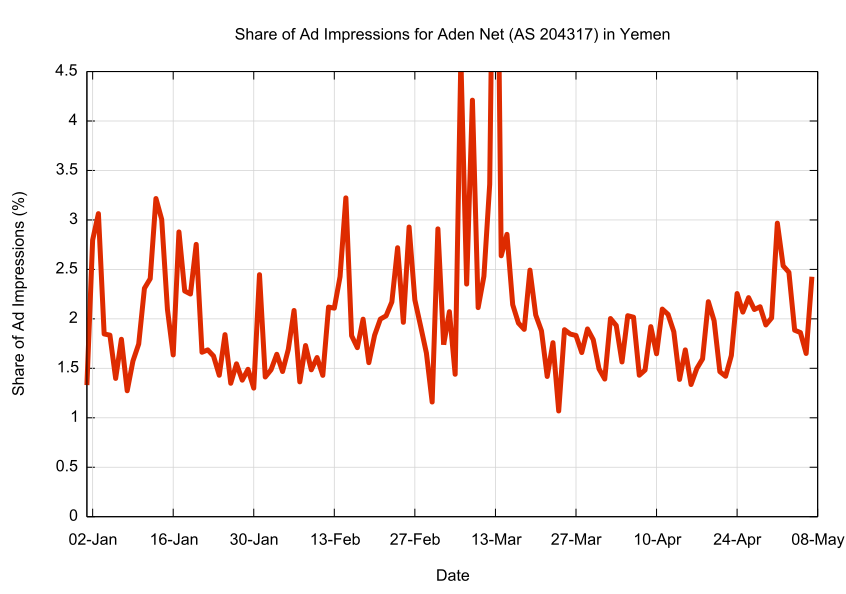

In the absence of any other data, we can use the observation that the user population of another Yemeni ISP, Aden Net, has been relatively steady in the first 4 months of 2025, at an average of 2.03% of the total number of ad's presented to users located in Yemen (Figure 2). Evidently, the port of Aden is not under Houthi control at present, nor is this particular ISP under Houthi control.

Figure 2 – Share of Daily Ad placement volumes for Aden Net (AS 204317)- Jan 2025 to May 2025

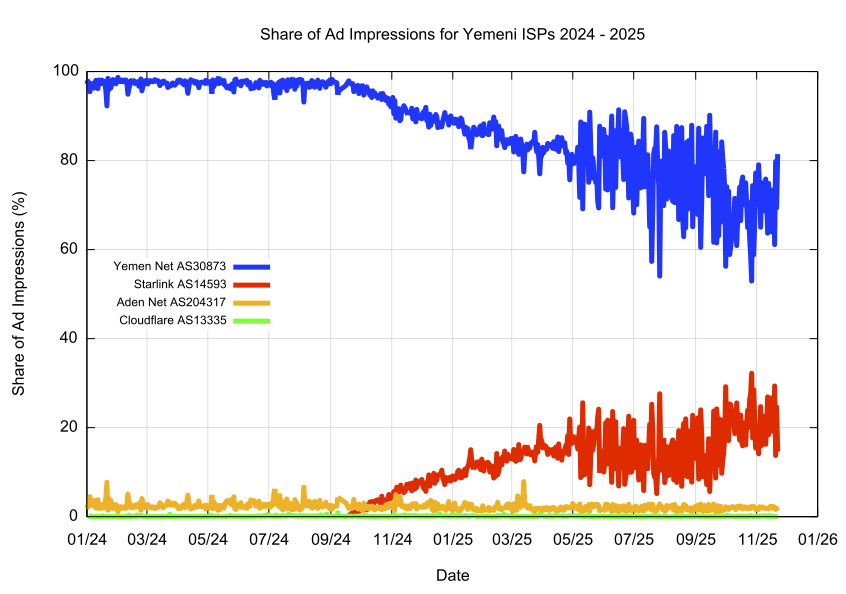

If we project this average 2.03% market share for Aden Net number forward, and use a random noise factor of +/- 0.4% for each day, we can derive a ratio between the count of Ad impressions and the estimate of the network's user population. This same multiplier that is used for Aden Net users can be applied to the other ISPs who service Yemeni users, namely Starlink (AS14593) and Cloudflare (AS 13335). This can provide us with an estimate of the total user population served by these three service providers. We also have a stable estimate of the total population of Internet users in the country, so we assume that the balance of Yemeni users is served by Yemen Net (Figure 3).

Figure 3 – Share of Daily Ad placement volumes for all Yemeni ISPs - Jan 24 – November 2025

The daily figures for the share across the Yemeni ISPs are far noisier from June 2025 onward because instead of deriving these daily numbers from some 28,000 ad impressions per day, we are using the data from Aden Net, which receives some 600 ad impressions per day, and the multiplicative factor used to derive the far larger Yemen Net numbers amplifies the daily variations in the estimated populations of Starlink and Yemen Net users. It's not exactly a satisfactory workaround, but it’s the best that can be done with partial data in this case, and better than simply discarding the Starlink use data for this country.

A Second Look at Data for Myanmar

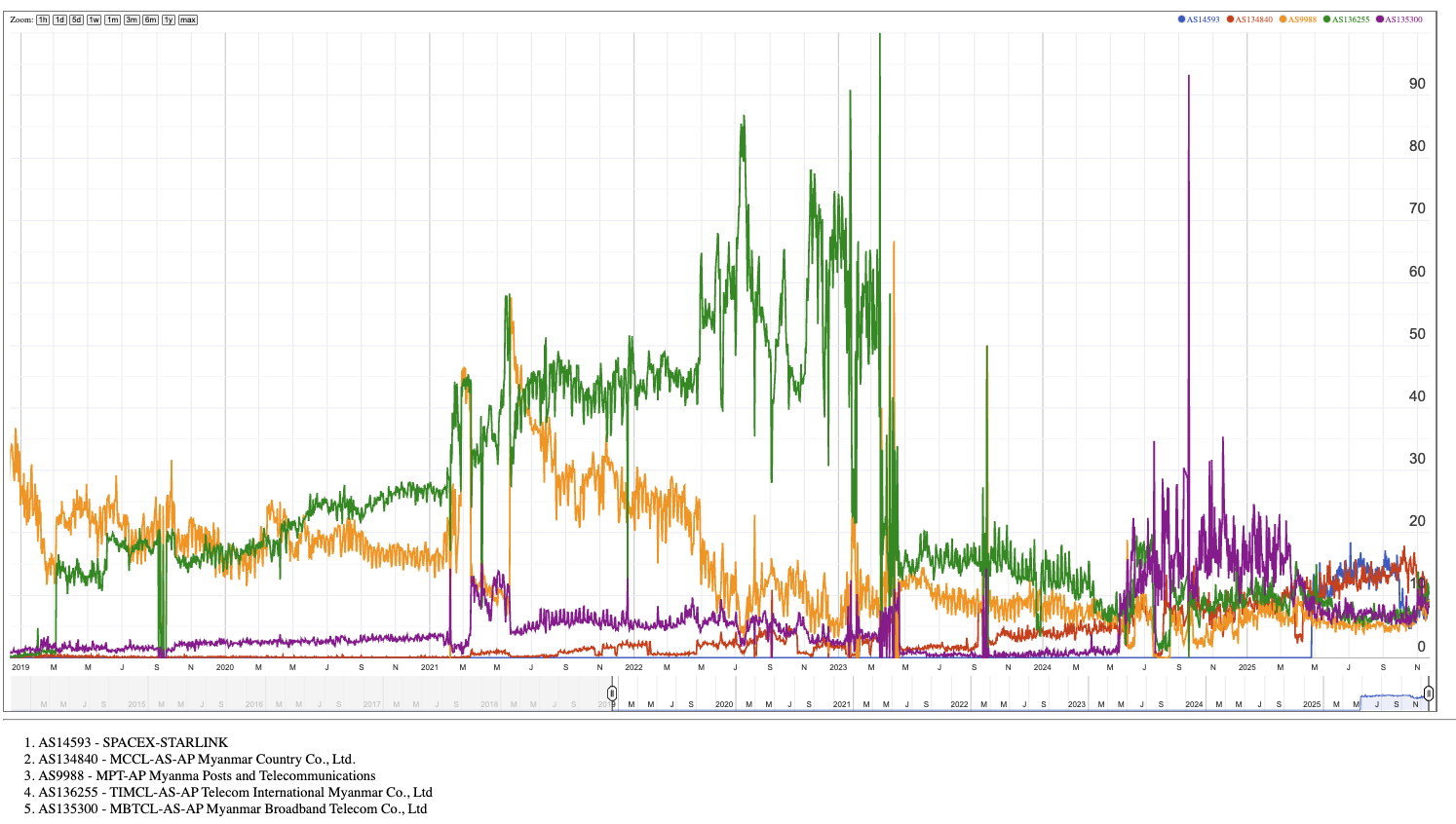

Myanmar is also enduring a period of civil unrest following a military coup in February 2021. There are some 100 networks that received our measurement ads over the past 10 days, and the overall picture of the division of the share of the domestic ISP market between the top 5 ISPs is shown in Figure 4.

Figure 4 – Relative Market Share of the top 5 ISPs in Myanmar – 2019 to 2025

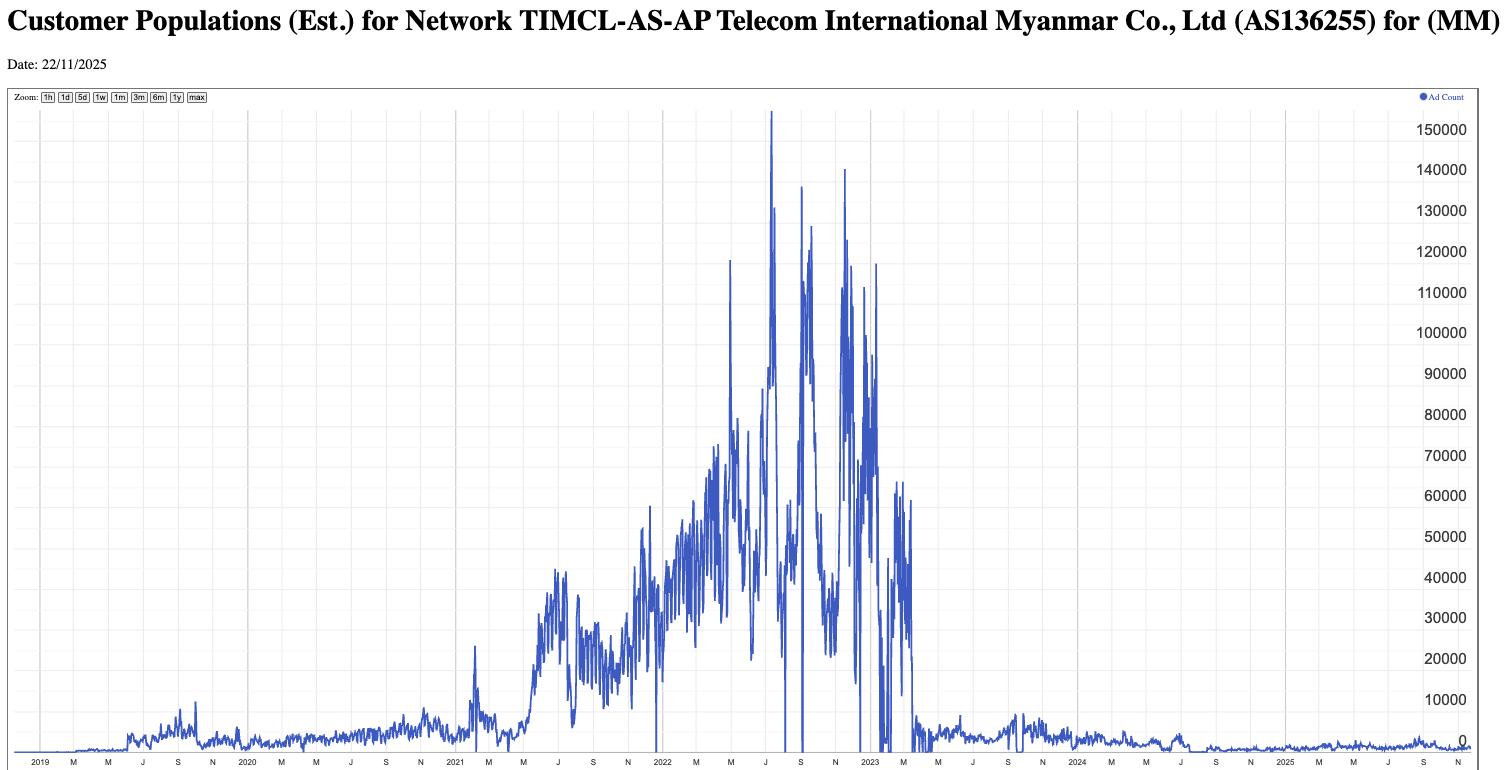

There is some evidence of a likely ad blocker being installed on some of these larger ISP networks. The daily ad count for Telecom International Myanmar, AS 136255, is shown in Figure 6, and it appear that an ad blocked was installed in that network in April 2025 (Figure 5).

Figure 5 – Ad Presentation Rates for Telecom International Myanmar, AS 136255 – 2019 to present

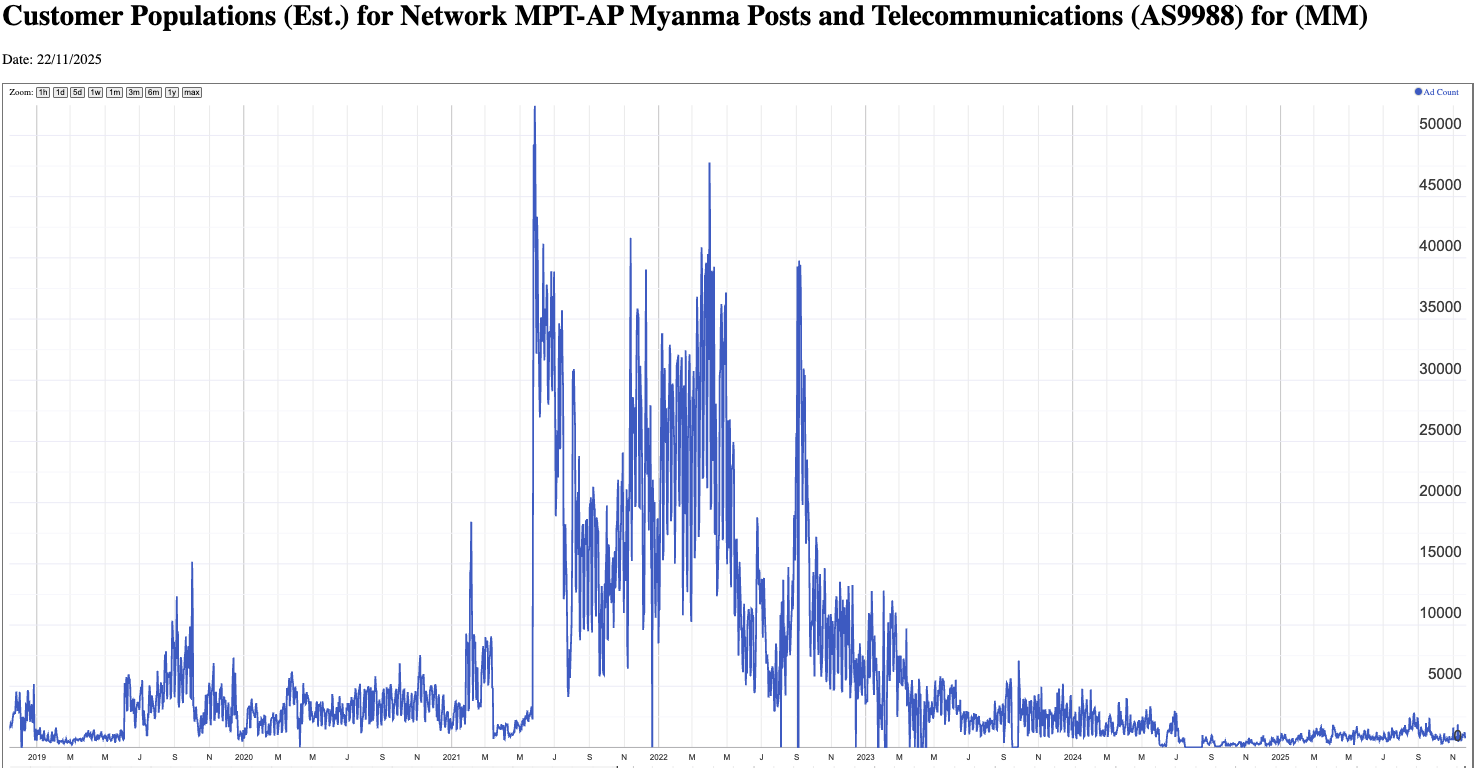

There is a similar story for AS9988, the ISP operated by Myanmar Posts and Telecommunications, as shown in Figure 6. There are numerous reports of various forms of content and service blocking, particularly as they relate of the use of VPNs, and it is possible that ad blocking measures were adopted by some ISPs in response to these government directives.

Figure 6 – Ad Presentation Rates for Myanmar Posts and Telecommunbicationa AS 9988 – 2019 to present

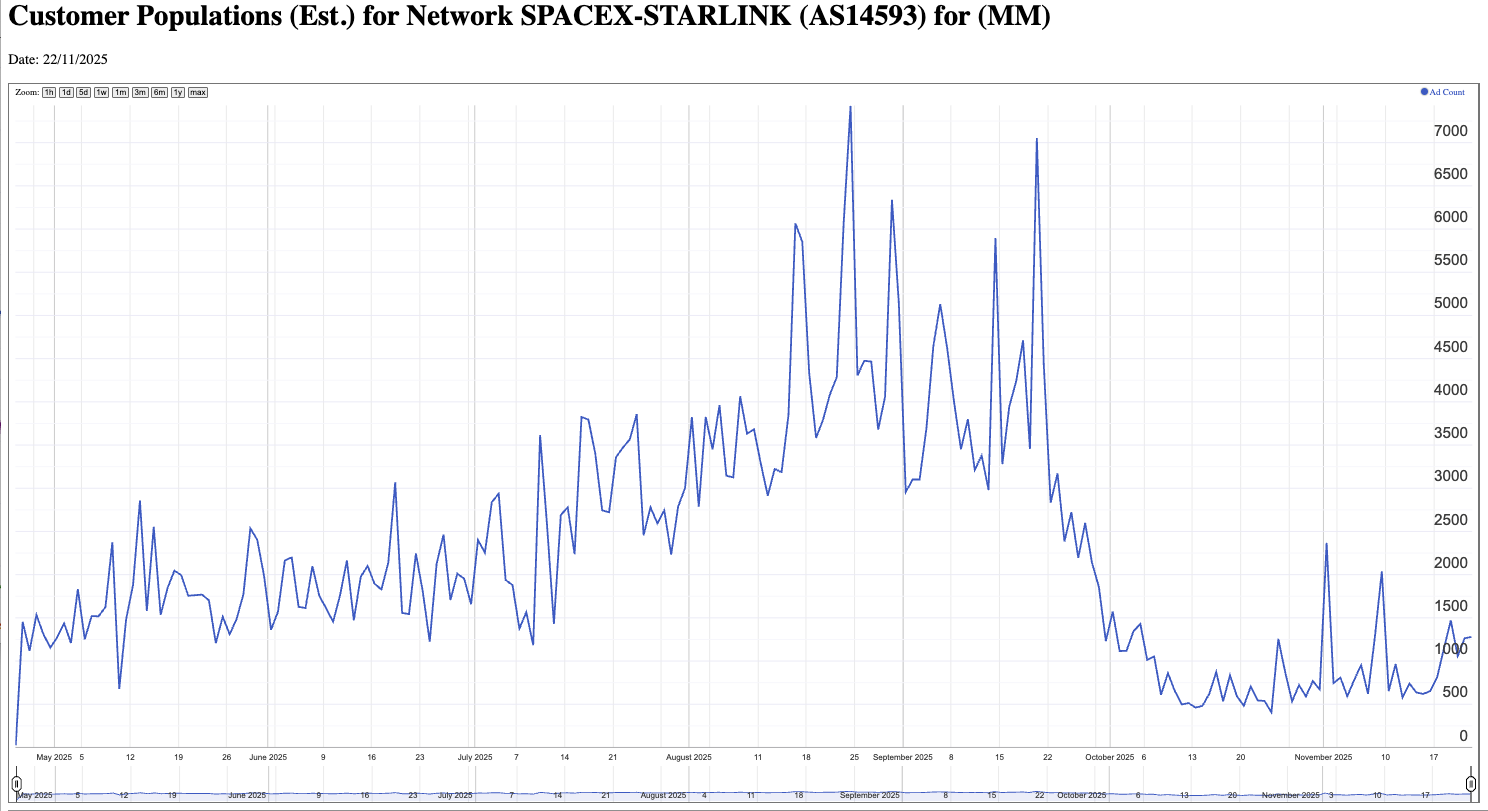

There are also reports of a government crackdown on scam centres in Maynmar, and these centres were reported to be making extensive use of Starlink services to undertake their activities. The Starlink service use since May 2025 to the present is shown in Figure 7.

Figure 7 – Ad Presentation Rates for Telecom International Myanmar, AS136255 – May 2025 to present

The situation in Yemen is contained to just four ISPs, so it has been possible to construct a model that will patch up the missing ad placement data from one of these ISPs. The situation in Myanmar is sufficiently complex that it is not possible to form a plausible model that could correct the missing ad placement data from two of the country's largest retail ISPs, so the data for this country is chaotic due to the absence of measurement of 2 of the country's largest ISPs.

Conclusion

The initial analysis of the anomalous data for Starlink users in some 20 countries lead to the conclusion that: "At APNIC Labs we've decided to override the Starlink geolocation data that refers to the 20 countries listed above and instead assign an “unclassified” designation to this part of the Starlink geolocation data."

This second look at the situation in Yemen has given us a lot more confidence in the fidelity of the Starlink geolocation data, and as a result I've removed the override I installed at the end of September and restored the original data and derived tables of ISP market share for these 20 countries.

The situation with respect to Myanmar is more opaque, due to suspected ad-blocking by two of the largest ISPs in that country, and it is not possible to device an algorithm that can paint a plausible picture of the market share of ISPs in that country. There is just insufficient information left that can be used to restore the data to the point where such a picture can be generated.

There is still an outstanding geolocation question concerning ships at sea, aeroplanes in flight, and details of the ways Starlink manages mobility and roaming, but Starlink is important enough in the overall picture of market share in many countries that it was unwise to arbitrarily reclassify this Starlink data for these 20 countries into the "unclassified" designation. Accordingly, I've restored the original data to the reports in their original geo-located countries.M

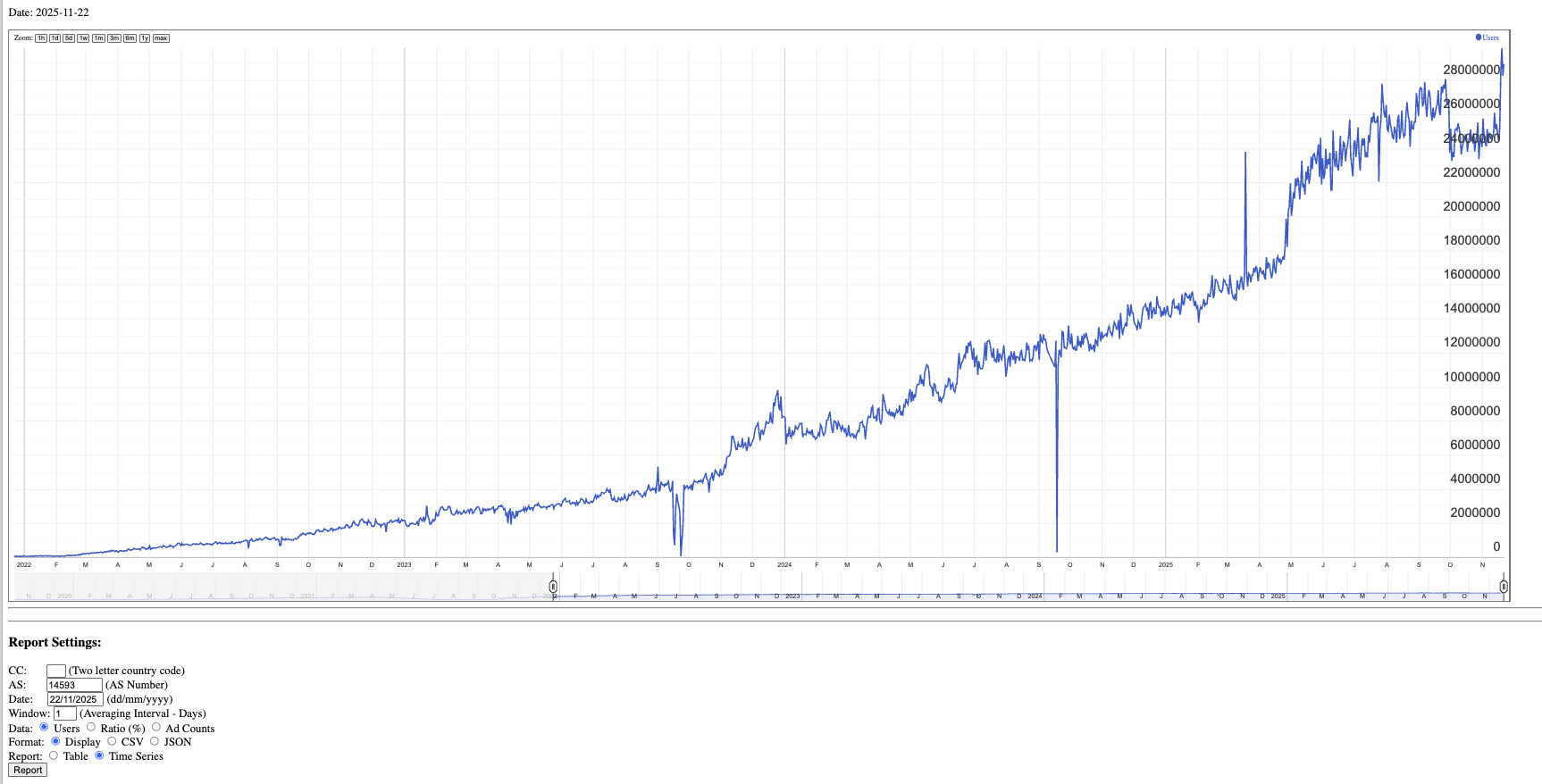

And what of the number of Starlink users world-wide? This data points to a current base of some 2.3M users, and a growth rate of 800,000 users per year so far (Figure 8).

Figure 8 – Time Series of estimate of the number of users using Starlink service for all countries

The reports of estimates of the user populations of networks can be found at https://stats.labs.apnic.net/aspop.

![]()

Disclaimer

The above views do not necessarily represent the views of the Asia Pacific Network Information Centre.

![]()

About the Author

GEOFF HUSTON AM, M.Sc., is the Chief Scientist at APNIC, the Regional Internet Registry serving the Asia Pacific region.